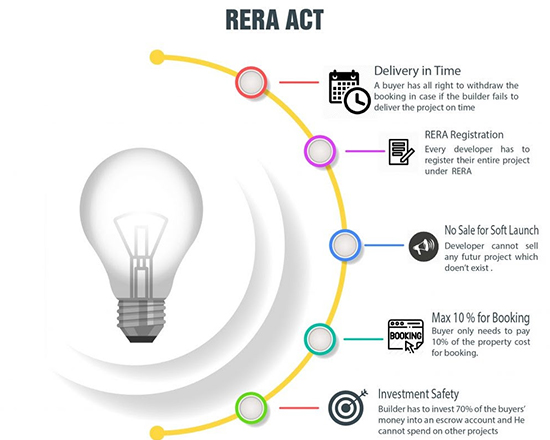

What is Rera Act?

The Real Estate (Regulation and Development) Act, 2016 is an Act of the Parliament of India which is responsible to protect home-buyers as well as help boost investments in the real estate industry. This Act establishes the Real Estate Regulatory Authority (RERA) in each state for regulation of the real estate sector and also acts as a regulatory for speedy dispute redressal.

RERA Act is to establish the Real Estate Regulatory Authority for regulation and promotion of the real estate sector and to ensure sale of plot, apartment of building, as the case may be, or sale of real estate project, in an efficient and transparent manner and to protect the interest of consumers in the real estate sector and to establish a monitory mechanism for speedy dispute redressal and also to establish the Appellate Tribunal to hear appeals from the decisions, directions or orders of the Real Estate Regulatory Authority and the adjudicating officer and for matters connected therewith or incidental thereto.

RERA, (Real Estate (Regulation & Development) Act, 2016 is the first set of the organised legal system to streamline the real estate industry. RERA Laws seek to bring transparency and accountability that would protect the interest of home buyers and regain the lost faith in the real estate industry.

-

Standardized carpet area

Earlier the carpet area on which the builder calculates the price of the property was not defined. Every builder/developer had his method of calculation of the Carpet Area For the same flat, the builder would calculate the carpet area as 1500 sq ft and the other would calculate the carpet area of 1400 sq ft.

Cost of Property = Carpet Area x Rate per sq ft -

Rate of interest on default

In case of default in payment by the buyer or default in completion of the project by the builder, the rate of interest to be paid shall be the same for both parties.

Earlier what used to happen was that in case the builder delays the possession of the property – the interest paid by the builder to the home buyer was less whereas in case the buyer defaulted – the interest to be paid by the buyer to the builder was higher.

-

Reduces the Risk of Builder Insolvency/ Bankruptcy

A developer usually has several projects which are being constructed simultaneously. Earlier Builders were free to divert the funds raised from Project A to fund the construction of Project B.

However, this would now not be possible as, after the introduction of RERA, the builder is liable to deposit 70% of the amount realized in for the project in a separate bank account. He can withdraw from such account only based on completion of the project, which shall be certified by a civil engineer, architect and a chartered accountant in practice.